[ad_1]

Reliance’s monetary arm – Jio Monetary Providers (JFS) lately launched an up to date model of its JioFinance app. The corporate launched a beta model of the app earlier this 12 months on Could 30 and has stated that it already has greater than 6 million customers.

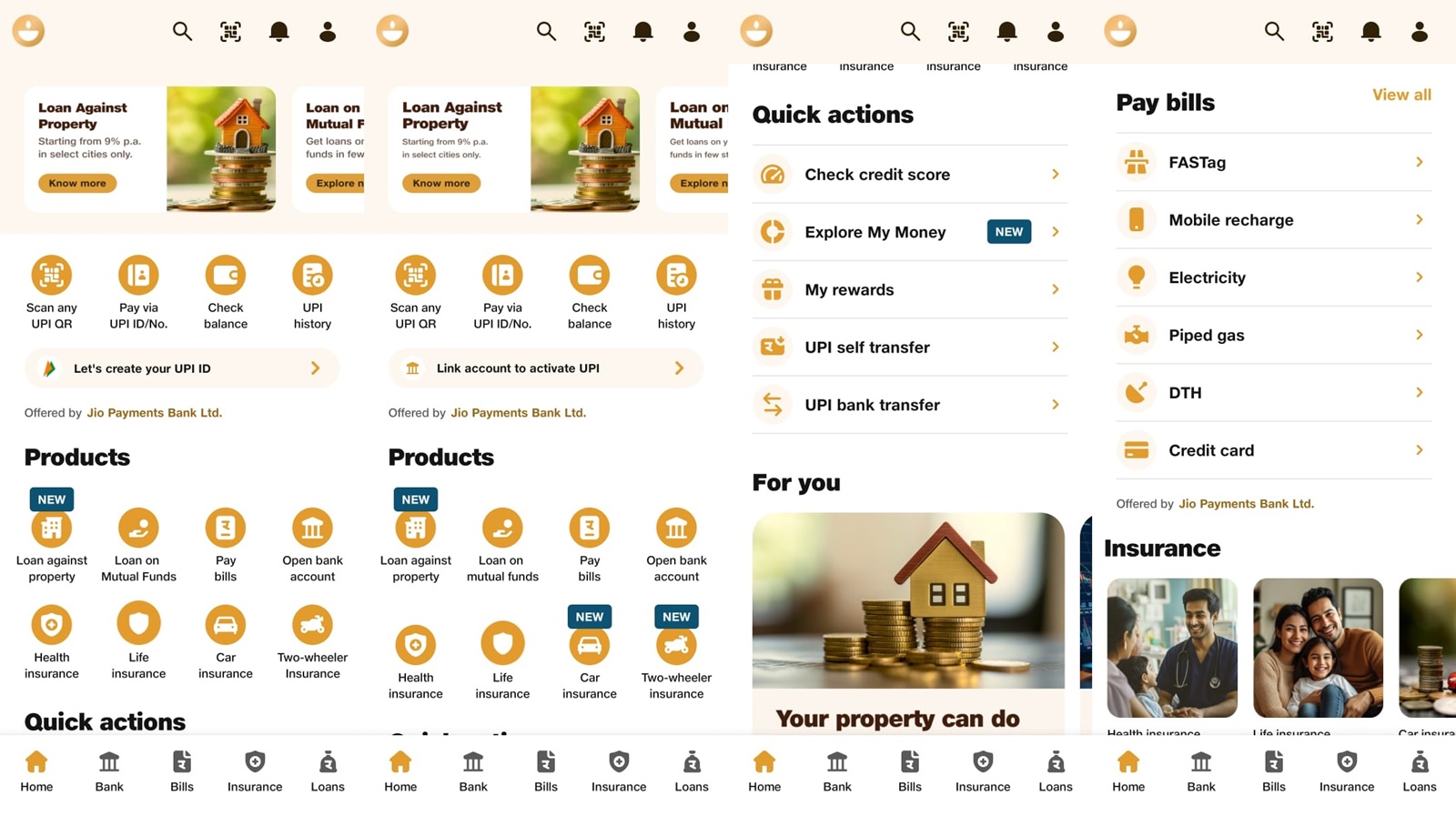

Going by the app description on the Play Retailer, JioFinance is a “one-stop app for quick and safe UPI funds, seamless invoice funds and personalised finance administration.” The app additionally helps you to see all of your mutual fund investments in a single window and even observe your private bills.

The up to date model of the app gives 24 digital insurance policy, which embrace the likes of life, well being, two-wheeler and motor insurance coverage. It additionally doubles as a UPI fee app like Google Pay and PhonePe, that means you possibly can scan a QR code for funds, pay by way of cellular quantity, provoke self-transfer and extra. The app additionally means that you can hyperlink and consider all of your financial institution accounts and mutual funds in a single place and analyse your earnings and bills utilizing the My Cash characteristic.

Reliance says JioFinance already has greater than 6 million customers. (Categorical Photograph)

Reliance says JioFinance already has greater than 6 million customers. (Categorical Photograph)

As for invoice funds, JioFinance can be utilized to pay bank card payments, FASTag, cellular plans, electrical energy, piped fuel, DTH and extra. JioFinance customers can even open digital financial savings accounts on Jio Funds Financial institution Ltd. in simply 5 minutes. For these questioning, the financial institution has greater than 1,5 million clients and comes with a bodily debit card.

If you wish to take a mortgage, the app lets customers get on the spot credit score on mutual fund funding and apply for mortgage towards property as much as 10 crore with the rate of interest ranging from 9 per cent per 12 months..

[ad_2]